Spring is the busiest season in the housing market. It’s the time of year when buyers are most active – that means it’s when homes sell faster and for top dollar. If you’ve already got a move on your mind, why not list this spring and take advantage of the added buyer demand?

Since spring is just around the corner, now’s the time to start getting your house market-ready. You’ve got just over a month to do the prep work. And while that may sound like a decent amount of time, it’s going to go by quickly. And you won’t want to rush through this important task – especially this year.

The Right Repairs Will Matter More This Spring

Right now, two things are true. There are more homes on the market than there have been in years. And buyers are being extra selective. That combination means you need to invest some time and effort in making strategic repairs. And many homeowners already have a jump on this work.

In the 2025 Outlook for Home Remodeling, Carlos Martin, Director of the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, explains:

“. . . homeowners are slowly but surely expanding the pace and scope of projects compared to the last couple years.”

And the most common projects they’re tackling are replacing water heaters, HVAC units, and flooring. Energy efficiency is a key consideration too, based on home improvement data from the Census.

What To Prioritize as You Plan Ahead

But just because that’s what other homeowners are doing, it doesn’t mean that’s what you have to tackle. Think about what you’d want to see if you were a buyer. Focus on quick wins that are easy to knock out with the time you have – but, don’t ignore key repairs, especially ones you think could turn off buyers.

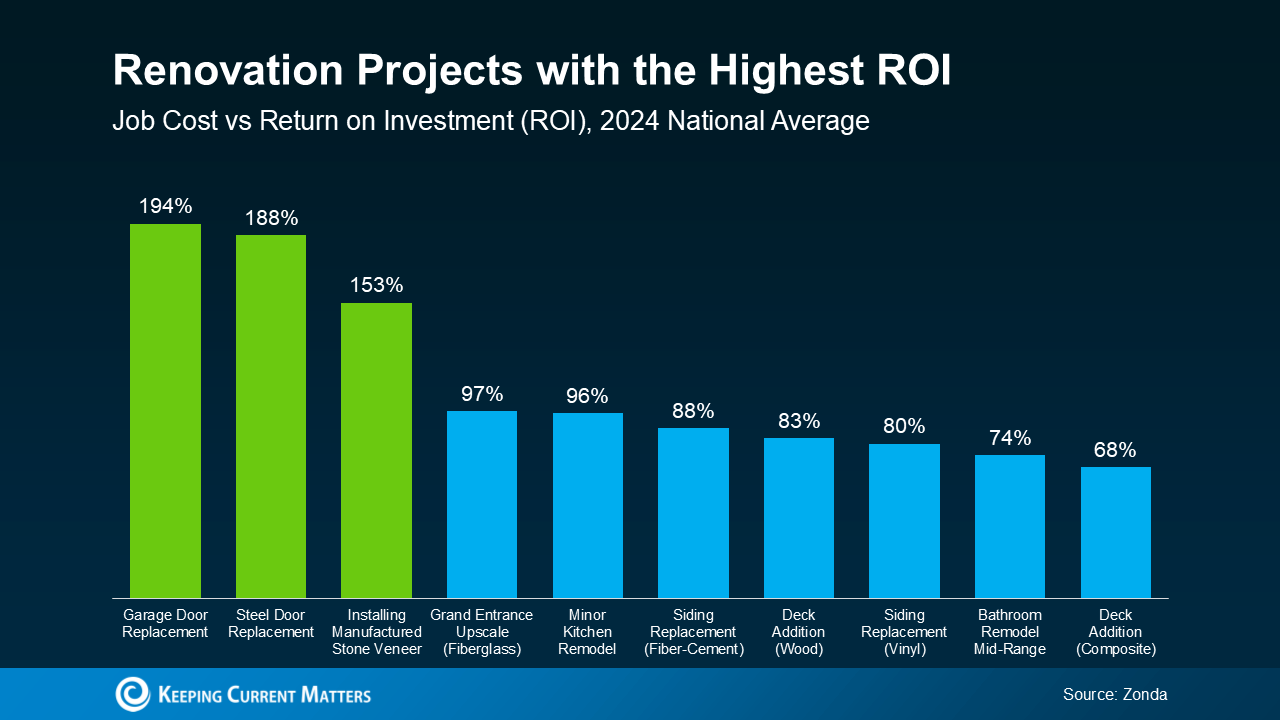

While big-ticket items like replacing an old roof or outdated flooring may seem daunting, they can pay off – especially if you focus on projects with the best return on investment (ROI).

An agent’s expertise is key in narrowing down your list to what’s actually worth it. They know what buyers in your area want and they also have data like this report from Zonda to guide you on which updates have the best ROI (see green in the graph below):

That’s why it’s so important to talk to me before you dive into any repairs. Bankrate puts it best:

“As a seller, it’s smart to be prepared and control whatever factors you’re able to. Things like hiring a great real estate agent and maximizing your home’s online appeal can translate into a smoother sale — and more money in the bank.”

It’s not too early to partner with me. By starting now, we still got time to space out the work and find any contractors you need to get the job done. If you wait until spring to roll up your sleeves, you risk running out of time – and that means your house may be overshadowed by others who are more buyer-ready.

Bottom Line

If you’re planning to sell this spring, it’s time to start tackling your to-do list. But, before you get started, connect with me. That way we can make sure you’re spending your time and budget on projects that’ll pay off in the long run.

Send me a list of what’s on your to-do list, so we can prioritize them together.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

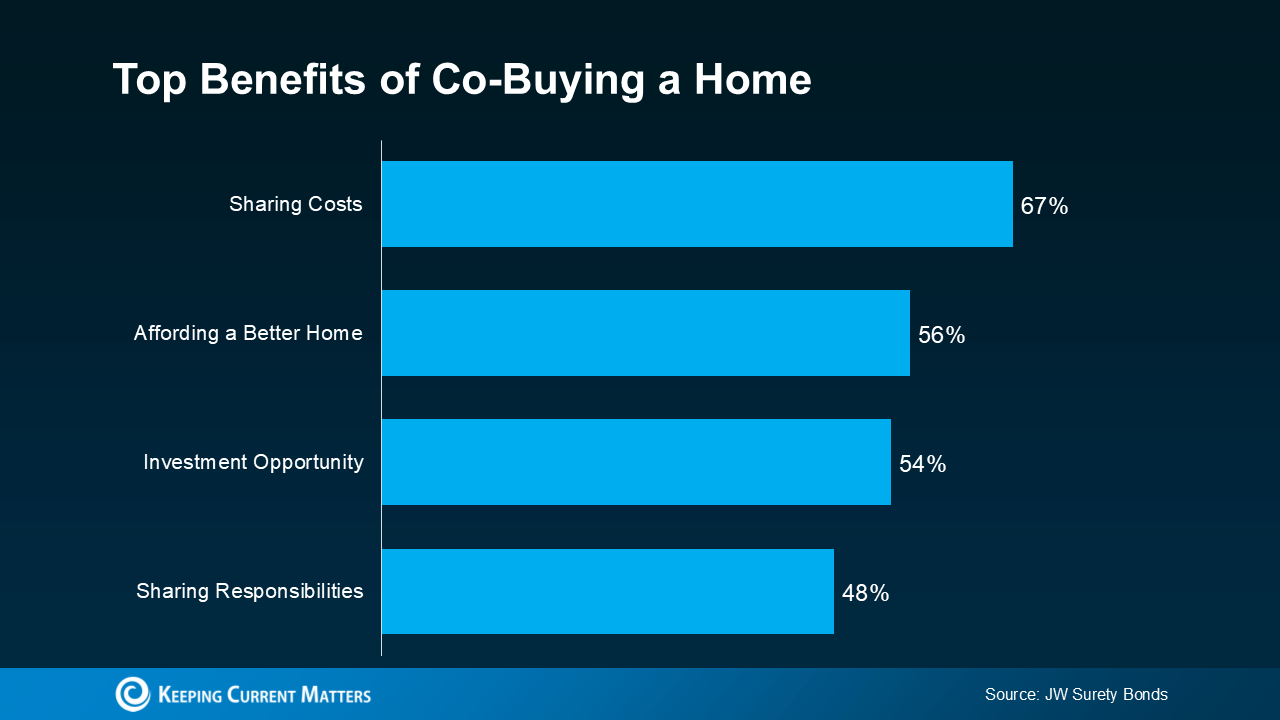

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.